House Prices: Simply a Matter of Supply & Demand

Why are home prices still rising? It is a simple answer. There are more purchasers in the market right now than there are available homes for them to buy. This is an example of the theory of “supply and demand” which is defined as:

“the amount of a commodity, product, or service available and the desire of buyers for it, considered as factors regulating its price.”

When demand exceeds supply, prices go up. This is currently happening in the residential real estate market.

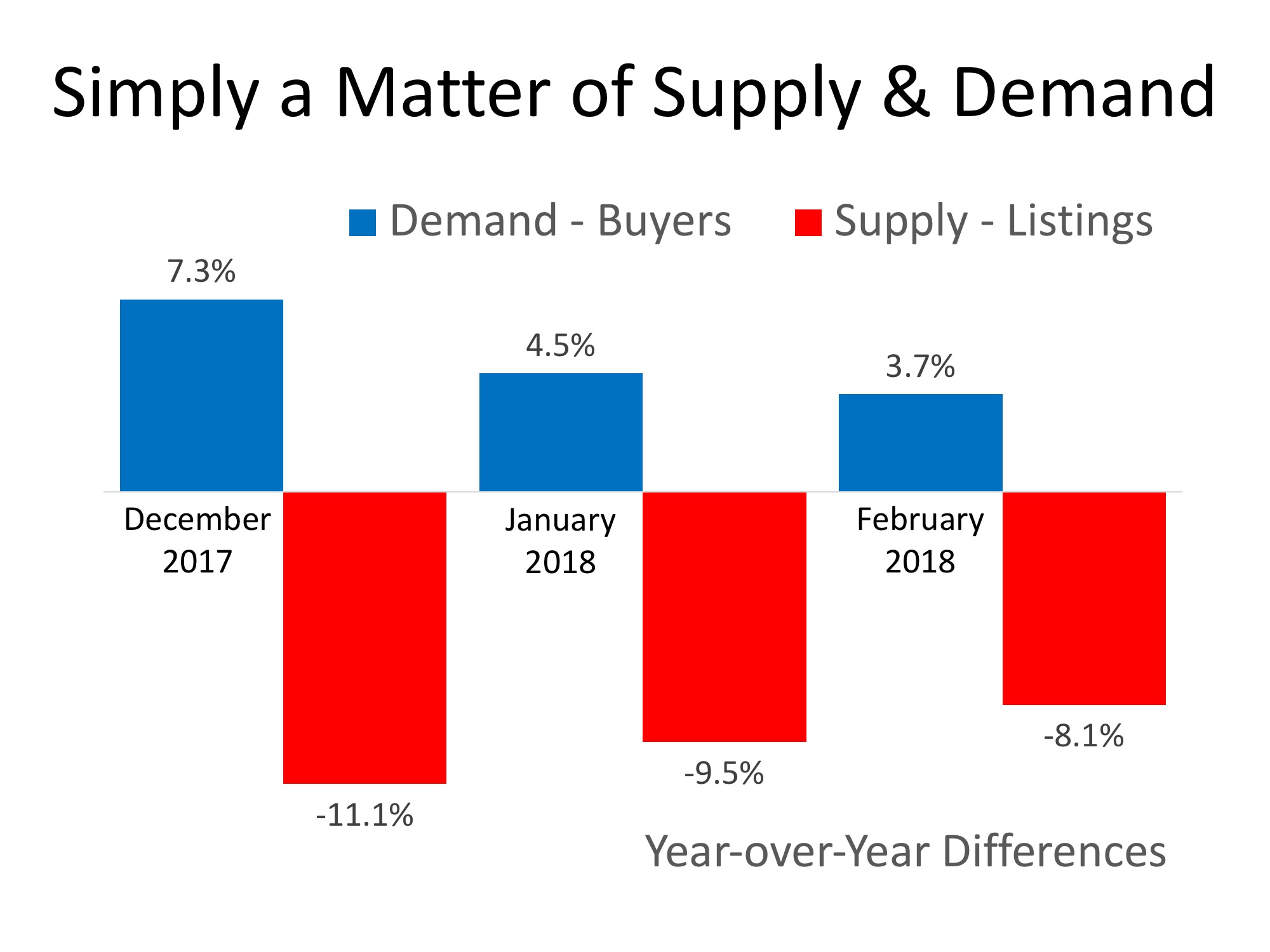

Here are the numbers for supply and demand as compared to last year for the last three months (March numbers are not yet available):

In each of the last three months, demand (buyer traffic) has increased as compared to last year while supply (number of available listings) has decreased. If this situation persists, home values will continue to increase.

Bottom Line

The reason home prices are still rising is because there are many purchasers looking to buy, but very few homeowners ready to sell. This imbalance is the reason prices will remain on the uptick.