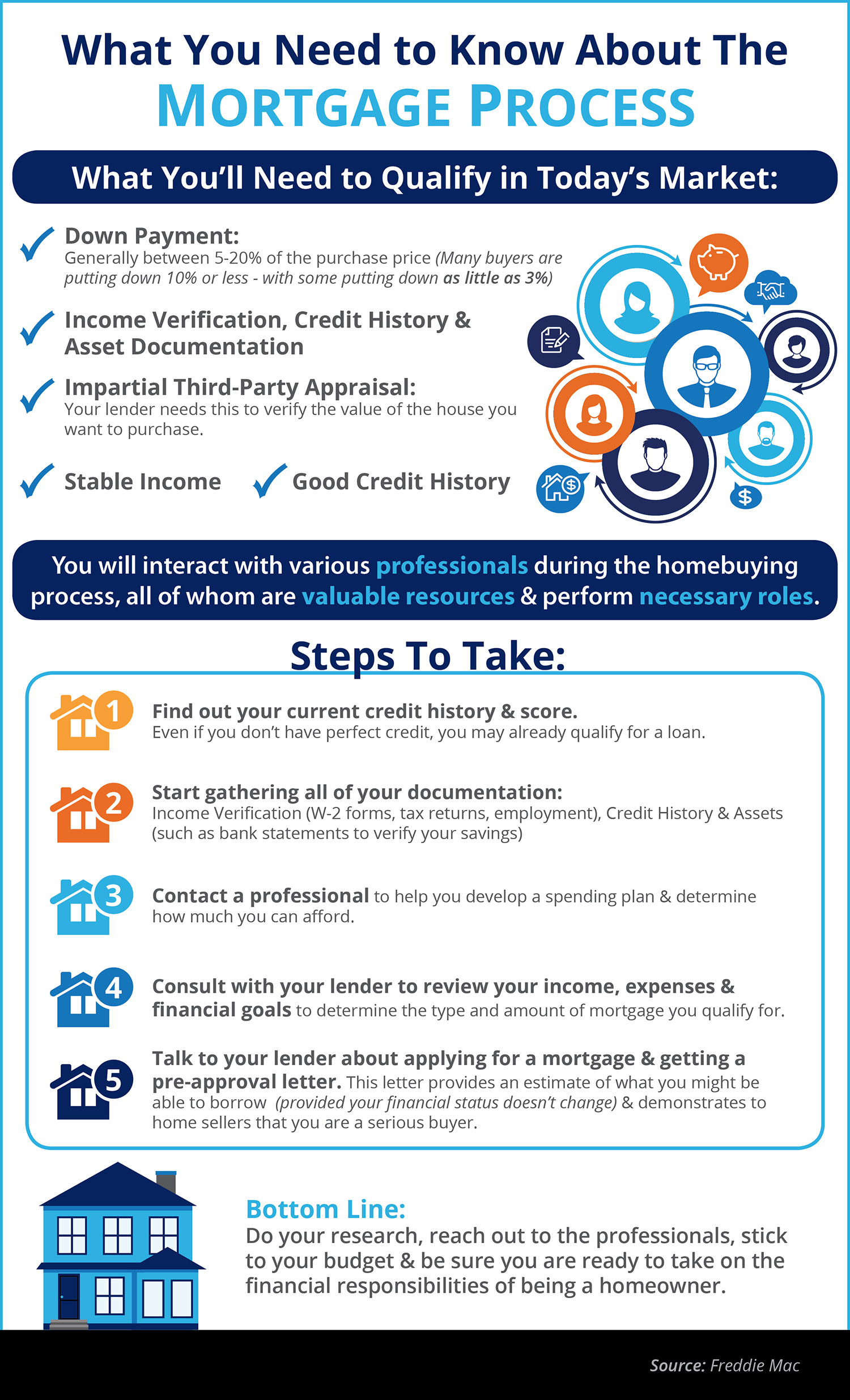

Some Highlights: Many buyers are purchasing a home with a down payment as little as 3%. You may already qualify for a loan, even if you don’t have perfect credit. Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

July 12, 2018

House-Buying Power at Near-Historic Levels

We keep hearing that home affordability is approaching crisis levels. While this may be true in a few metros across the country, housing affordability is not a challenge in the clear majority of the country. In their most recent Real House Price Index, First American reported that consumer “house-buying power” is at “near-historic

July 11, 2018

Rising Interest Rates Have Not Dampened Demand

Since the beginning of the year, mortgage interest rates have risen over a half of a percentage point (from 3.95% to 4.52%), according to Freddie Mac. Even a small rise in interest rates can greatly impact a buyer’s monthly mortgage payment. First American recently released the results of their quarterly Real Estate Sentiment Index (RESI), in which

July 10, 2018

How Long Do Most Families Live in a House?

The National Association of Realtors (NAR) keeps historical data on many aspects of homeownership. One of their data points, which has changed dramatically, is the median tenure of a family in a home, meaning how long a family stays in a home prior to moving. As the graph below shows, over the last twenty

July 6, 2018

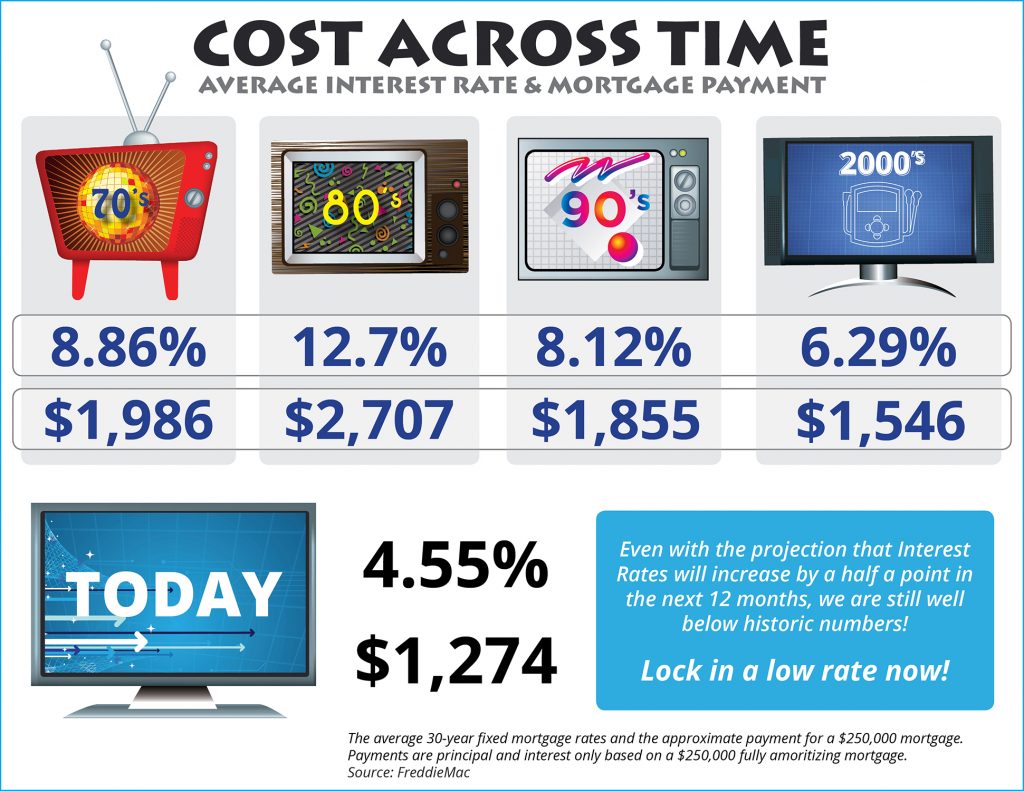

Cost Across Time [INFOGRAPHIC]

Some Highlights: With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years. Rates are projected to climb to 5.1% by this time next year according to Freddie Mac. The impact your interest rate makes on your monthly